The Financial Lesson Behind James Van Der Beek’s Passing (What Families Need to Know About Protection and Risk)

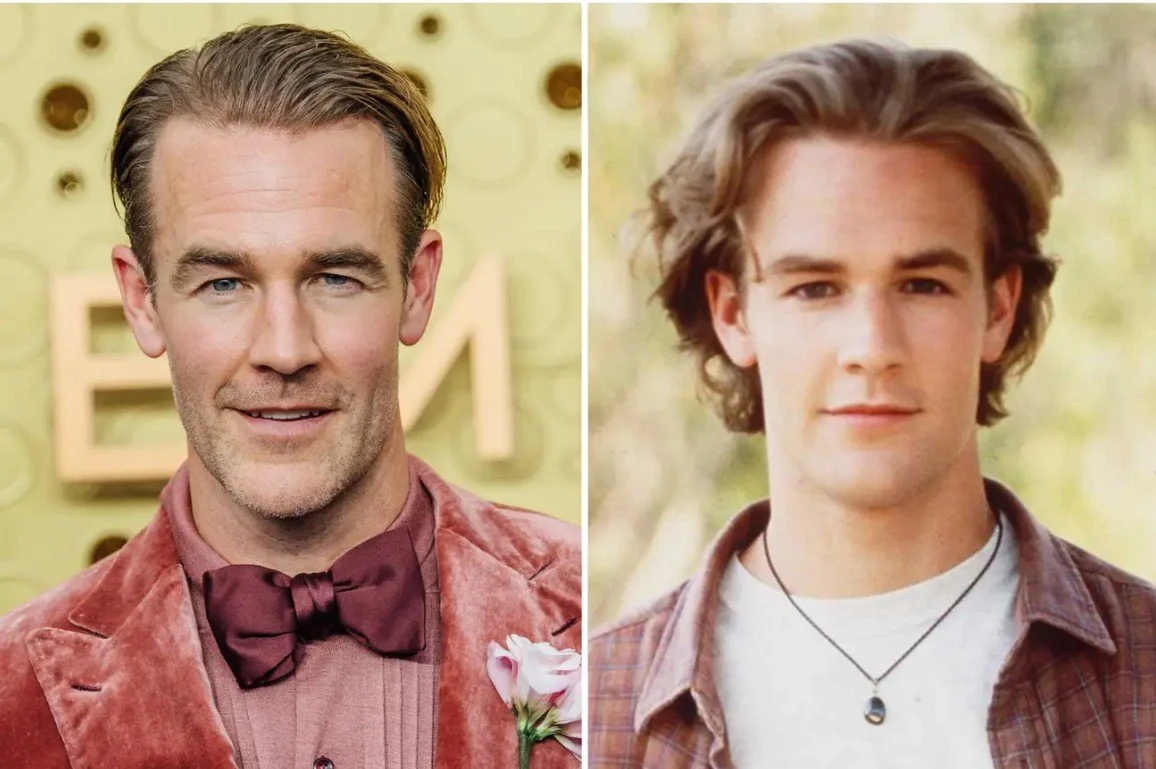

We were all a little stunned by the news of James Van Der Beek’s passing. He died at just age 48 after a long battle with stage 3 colorectal cancer. For many of us, he was a fixture of our youth, a lot of us grew up watching him as Dawson Leery on Dawson’s Creek.

There were the expected tributes, co-stars, fans, and fellow creatives sharing memories and love online. But behind the tributes is a story that has left many people uncomfortable: a $1 million GoFundMe was set up to keep his wife Kimberly and their six children in their home.

The immediate reaction on social media was a mix of confusion and judgment. For many, it raised a lot of questions: “He was a movie star, how could he be out of money?” “Shouldn’t someone with a long career in Hollywood have enough saved?” These are human questions, but as a financial professional, I don’t see a "celebrity who failed." I see a man who fought a three-year battle with Stage 3 colorectal cancer, a disease that is increasingly hitting people under the age of 50. I saw a father who tried to protect his family while his primary "asset" (his ability to work) was taken away.

Photo Credit to Instagram Account - @vanderjames

This actually point to something important about how we think about (or sometimes don’t think about) money, security, and risk. I don’t want to speculate about celebrity. I want to talk about what this situation illustrates for regular families like ours, for our finances, and for the hard reality that a high income is not the same as financial security.

More often than not, people see financial security as a number on a paycheck. We think, "If I can just make $200k (or $500k, or $1M), I’ll finally be safe." But income is not wealth. Income is a stream; wealth is a reservoir. And even the biggest reservoir can be drained if the outflow is greater than the inflow.

James shared publicly that he’d been living with a serious cancer diagnosis for years before his death. He fought it with courage and openness, even if the world only saw bits of it. His diagnosis didn’t just suddenly stopped his life. The expenses of a household with six children continued. Add to that the "financial toxicity" of modern cancer care. In the U.S. and even here in Canada, the out-of-pocket costs for specialized oncology, experimental treatments, private nursing, and travel for care, they can reach tens of thousands of dollars per month.

When a high-earner stops working to fight for their life, they aren't just losing their salary; they are often burning through assets to stay alive. James was reportedly selling off "Dawson’s Creek" memorabilia and personal treasures just to fund his treatments. That is the definition of financial desperation.

In the months leading up to his passing, friends and supporters organized a fundraising effort on GoFundMe to help his widow and children with living costs, bills, and educational stability. The campaign broke through $1 million in under 24 hours and went on to raise more than $2 million in just a couple of days.

The organizers described why they launched it: the extended fight against cancer had left the family out of funds, and they wanted to help ensure the children’s home life and education could continue with stability.

That for me, isn’t about criticism. It’s about reality.

Photo Credit Emma McIntyre/Getty Images, Warner Bros

Money is not just about income, it’s about protection.

Let’s pause here and be honest with ourselves, we are living in an era where the "prime years" are also the "risk yeas." We are having children later, taking on larger mortgages, and supporting aging parents—all while our own health risks begin to climb.

James’s story is a wake-up call, he was physically fit, a "biohacker" who did cold plunges and saunas. He was the picture of health until a routine colonoscopy at age 46 changed everything. His storyr proves that medical debt is the great equalizer. It doesn't care about your IMDb credits or your title at the office. If you are the primary breadwinner, your family’s entire lifestyle is built on a single point of failure: your health.

Our income is cash flow, not a safety net. It’s money we receive as long as we can produce work — as long as our health, energy, and time allow. But it doesn’t guarantee security when something stops us from earning. And illness, unfortunately, doesn’t wait for our planning.

For most of us, a job provides regular income, but we don’t live pay check to pay check because of a lack of effort. We live pay check to pay check because life has risks we don’t spend enough time preparing for. If you never protect your earning ability, your health, and your family’s future properly, then all that income evaporates when it matters most.

And that’s the part most people don’t think about until it’s too late.

Crowdfunding is Not a Financial Plan

Platforms like GoFundMe can be powerful tools for community support. People’s generosity for Jame’s family is beautiful.

But here’s the truth: Crowdfunding is reactive. It’s hope, not a plan. It is not a strategy, it’s a gamble. For every celebrity GoFundMe that hits $1 million, there are thousands of families whose pages never break $500.

Relying on strangers, no matter how kind they are, is not something you want to count on when your family is in crisis. A financial plan is about ensuring that if the "what-ifs" of life hit you, a diagnosis, a disability, or an untimely passing, the funds are already there, guaranteed by a contract, not a viral post.

I’m not putting this story up to judge, I’m not here to question anyone’s motives. But I am here to remind you of this: Financial planning isn’t just about winning. It’s about surviving. And thriving during uncertainty.

A high income feels comfortable. But comfort isn’t protection. Security is when you and your family can still put food on the table, pay the bills, and keep moving forward even when life throws something you never saw coming.